i7 Insurance

Life Insurance

Health Insurance: Making Sense of Today's Landscape

Individual and family health insurance plans can help cover expenses when you or your family has a serious medical emergency, and it can also help you and your family stay on top of preventative health-care services. A good health insurance plan can save you money on doctor’s visits, prescriptions drugs, preventative care and other health-care services. Typical health insurance plans for individuals and families include such costs as a monthly premium, annual deductible, copayments, coinsurance, and out-of-pocket maximums.

Who Needs Health Insurance?

Everyone needs Health Insurance, especially with health costs continuing to skyrocket. Trying to understand all the terms, limits, percentages, exclusions, tiers, and so on can get overwhelming.

How i7 Insurance Can Help

As an independent agent, I have your best interests at heart. I am here to “hold your hand” so to speak, and guide you through the process to assist you and your family in enrolling into a health plan that’s really going to work for you!

Critical in making a choice of plans is to know what’s going to be covered, and if so, how much will be covered. Thinking one is covered for a certain procedure when it’s very clear in the summary of benefits for the policy that it’s not covered has gotten more than a few people in big financial trouble! In addition, there are 2 main dollar amounts I put my focus on when looking at how much one’s medical costs are going to be in a year, and neither one of them is the monthly premium. True, the monthly premium is important, but not fully understanding the per person/per family annual deductible and out-of-pocket maximums (often seen written as MOOP) are what cost many families serious financial burdens.

Be Prepared to Answer These Health Related Questions on Health Enrollment Applications

Date of Birth / Height / Weight / Tobacco Usage (YES or NO) / Any current Rx’s and medical conditions / Insulin Dependent (YES or NO) / History of Pre-existing conditions (Heart disease, Heart attacks, Strokes, Cancer, Diabetes, Auto Immune Disease, etc.) / If you have had cancer, are you cancer free for more than 5 years (YES or NO)

i7 Insurance will also need to know: Is maternity coverage important to you? / Do you have a target budget?

Hint: Think through what you LIKE and what you DISLIKE about your current coverage.

Pre-Existing Conditions

Although the exact definition may vary depending on your state, in Alabama pre-existing conditions are generally conditions for which you received treatment, were recommended to have treatment, or have the symptoms that a prudent person would seek treatment for during the 12 (or 24) months preceding your coverage effective date. For example, Philadelphia American excludes coverage for pre-existing conditions during the first 12 months of coverage. However, Aliera Healthcare excludes pre-existing conditions (with some exceptions) for the first 24 months. You should expect medical bill advocates (aka. claims adjustors) to scrutinize all substantial claims which occur during the 12 or 24 month exclusionary period.

Let’s take a “for instance” of a procedure which might be deemed as a pre-existing condition: the colonoscopy. Going to our earlier example, after 60 days of coverage with Philadelphia American’s Health Choice Select and Health Saver Plus policies, they will pay a wellness benefit of $360.00 towards a colonoscopy. In the event that a polyp is found during the procedure, the claim is no longer considered a wellness benefit and it is paid as “medically necessary.” However, if you have a wellness colonoscopy during the first year, the claims adjuster will likely request copies of your medical records to see if you had “been advised to have treatment or had the symptoms that a prudent person would seek treatment” for a condition such as proctitis, colitis, IBS, or a history of polyps. If so, there is a chance that the procedure might be deemed a pre-existing condition.

Think of it this way: since few people want to have a colonoscopy—and without symptoms or a diagnosis, it’s not urgent to have a colonoscopy—it is logical to deduce that a person who has a sense of urgency to have a colonoscopy performed must have some kind of symptoms which are creating that sense of urgency. So unless you really are having an onset of symptoms, you would probably be better off to wait until your policy’s pre-existing condition exclusionary period is over before having a voluntary procedure performed so that there is little chance of having the claim denied.

You will also want to be aware that if you submit a large illness claim within days or weeks of your policy becoming effective, it will probably be highly scrutinized, especially if it involves having several diagnostic tests performed. One of the first things that a doctor is going to ask you is, “How long have you felt this way?” From an insurer’s perspective, it is highly unlikely that you will be asked to have a CAT scan or an MRI or extensive lab work if your symptoms just started within the past few days and have never occurred before.

The reason insurers utilize a pre-existing condition exclusionary period is to prevent people from waiting until they are sick or hurt to buy health insurance. If policyholders could receive thousands of dollars in benefits after only paying around $500 for premiums, it would not be long before the insurance company would not be able to pay any claims for anybody. This is exactly why the Affordable Care Act cannot work without tax payer subsidies.

Bottom Line Tip: Be careful not to give medical providers a blank check when it comes to diagnostic work. Ask medical providers how much they charge and shop around before having scheduled diagnostic procedures.

Keep in mind that doctors aren’t paying your bill and often have no idea how much the procedures they are recommending cost. Sometimes they are recommending diagnostic evaluation more for professional liability reasons than for medical reasons. You owe it to yourself to stay on top of your health just don’t do so with blinders on.

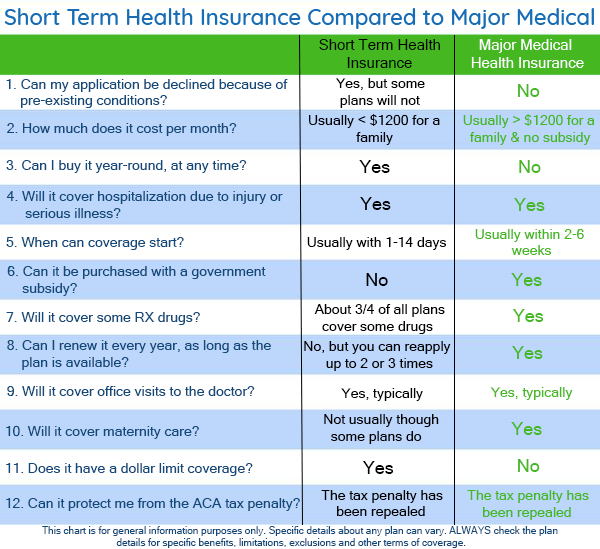

Short Term Health Insurance Vs. Major Medical

Many people do not understand Short Term Health Insurance and therefore are unwilling to examine how it could be the answer to their “health insurance woes.” According to the Alabama Department of Insurance, insurers are allowed to offer short-term plans with initial terms up to 364 days and the option to renew for a total duration of up to 36 months. But insurers also have the option to offer shorter maximum terms and to prohibit renewal. Some are choosing to offer plans with terms of up to six months, while others are offering 364-day policies. While getting a short term plan might be too risky for some, especially if they qualify for significant subsidies on the Health Exchange (Affordable Care Act, aka. Obamacare), for many people bundling a good short term plan with guarantee renewables for 36 months along with a hospital indemnity plan, an accident/disability rider and a short term “medical wrap” could end up saving them thousands of dollars over a major medical plan and provide as good or even better coverage in many cases.

One of first things you will notice about some short term medical plans is that you will see the disclaimer on certain policies that “This insurance is not ‘Major Medical’ coverage”. That term was adopted by the ACA, which requires all “Major Medical” insurance to provide what the ACA deems “Essential Healthcare benefits” such as maternity. Many short term plans pay benefits for covered claims which any prudent person would consider “major,” but is NOT Obamacare. That’s actually to your advantage because it means that you don’t have to wait until open enrollment to get you and your family covered, and you won’t be charged huge premiums for high deductible plans. In addition, you don’t pay for coverage that you don’t need, such as maternity.

Why Should I Get Short Term Health Insurance?

- Affordable rates – Compared to major medical plans, short term health insurance can have low, affordable premiums.

- Peace of mind – A short term health plan can help you bridge the coverage gap, providing protection for you and your family in the event of a medical crisis.

- Quick approval – Many applicants are approved and get proof of insurance quickly, usually within 7 days, sometimes even day of enrollment.

- Flexible terms – Short term health plans can cover you for any period from 30 days up to 3 years in Alabama at present.

- Change of employment – Laid off? Job loss? Get covered while in between jobs and employee benefits.

- No ACA Open Enrollment – Can’t get major medical coverage? A short term health plan could get you to the next open enrollment period.

- Before Medicare – Waiting for coverage because you are aged 63 or 64? A short term health plan can help protect you in the meantime.